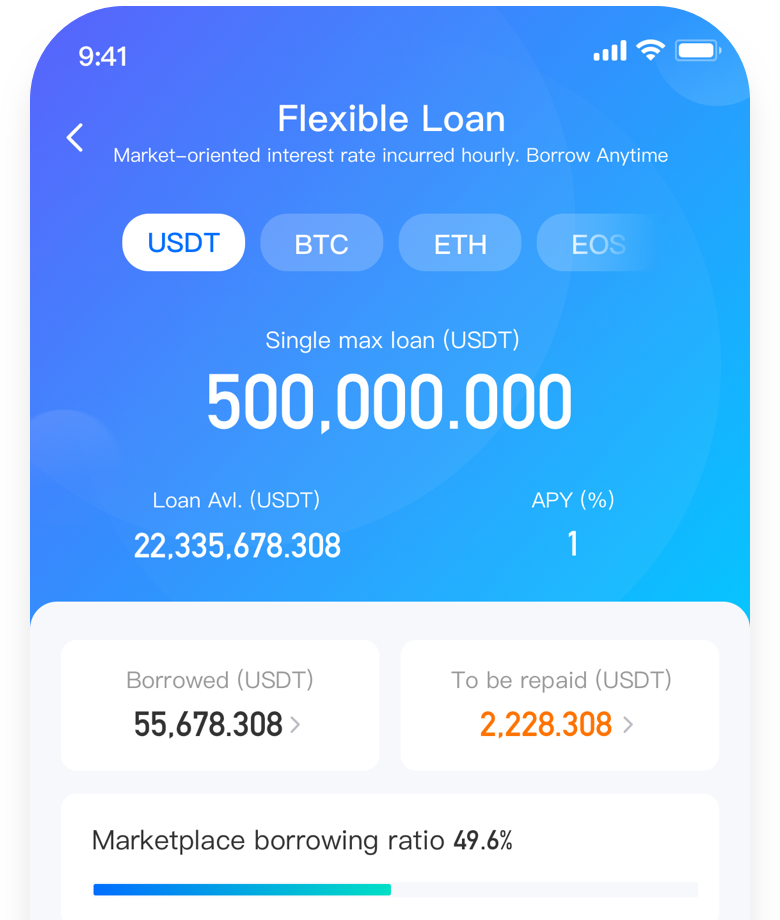

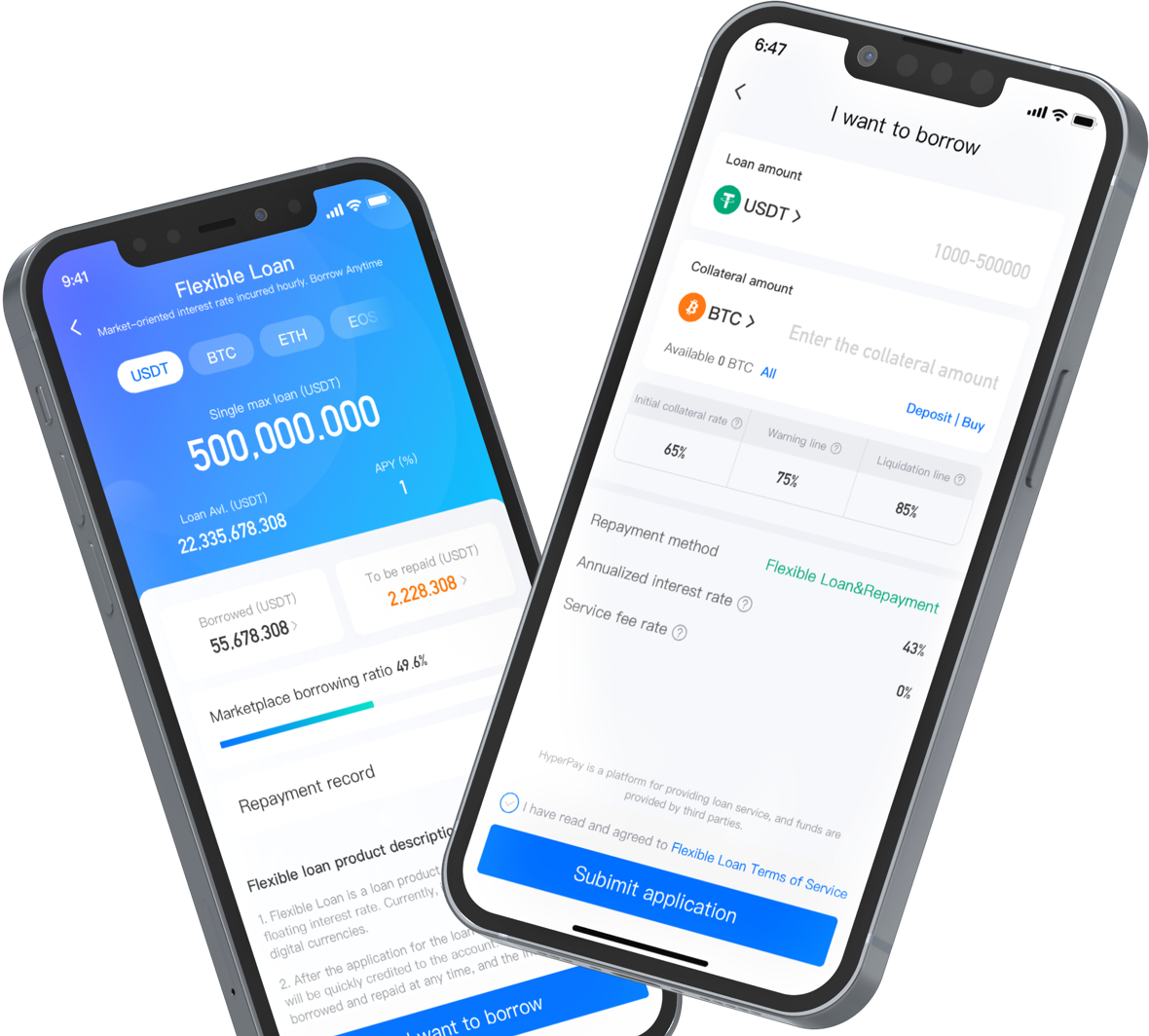

Collateralize digital assets to borrow stablecoins

Total Trading Value Exceeding

$8,500,000+

Ultra-low rate, fast loan

Safe collateralization

Fast loan

Fast loan

Lend with

Steady profits

Steady profits

HyperPay Loan • Professional and Reliable

Ultra low rate

Ultra-low loan rate, flexible floating rate, high capital utilization, to lower user costs

Fast loan, flexible repayment

The operation is more convenient, the application is fast, and the loan funds are used anywhere.

Safe and secure

Multiple control measures are set up in user verification, loan application, and account security management to ensure the security of user assets

Rates & Fees

| Collateral currency | Collateral currency 20+ |

HBT HBT

|

ETH ETH

|

BTC BTC

|

LINK LINK

|

ADA ADA

|

XRP XRP

|

ATOM ATOM

|

FIL FIL

|

... |

| Pledge Ratio | 70% | |||||||||

| Loan rate (annualized) | Min annualized 0.88% | |||||||||

| Loan Currency |

|

BTC BTC

|

ETH ETH

|

|||||||

| Loan Term | Unlimited | |||||||||

What Our Customer Say

Over 10,000 customers use BitLoan for their crypto borrowing and lending

Andrew

Crypto Trader

Elizabeth

Investor

HyperDAO

Decentralized Financial Service Platform

Fast, Flexible & Convinient

Pledge your crypto asset to borrow the funds in you own needor finance a portfolio of loans and earn interest.

Stake now